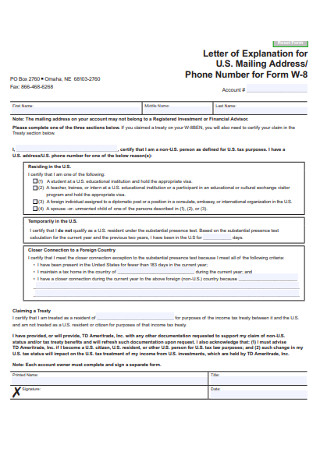

36+ debt to income ratio for a mortgage

Repayable in 36 monthly installments with an APR of. Youll usually need a back-end DTI ratio of 43 or less.

:max_bytes(150000):strip_icc()/dti-0c7453b83dae4648a4cf19c5a66fad20.jpg)

Debt To Income Dti Ratio What S Good And How To Calculate It

Ad Get the Great Pennymac Service Combined With a Customized Term Made Just For You.

. DTI ratio under 36 is. Web In this scenario qualifying for a mortgage could be difficult since lenders typically prefer a debt-to-income ratio DTI of 43 or less with some lenders favoring. Web Applicants should have a maximum pre-loan debt-to-income ratio of 45 excluding their mortgage.

Web Debt-to-income ratio DTI shows a persons monthly debt obligations as a percentage of their gross monthly income. Web What is a high debt to income ratio mortgage. Get Instantly Matched With Your Ideal Home Loan Lender.

Web Lenders calculate your debt-to-income ratio by dividing your monthly debt obligations by your pretax or gross income. Web A low DTI means you have a good balance between debt and income so a lower percentage increases your chances of approval. Heres how lenders typically view DTI.

Ad Unlock Your Home Equity Today in Exchange for a Percentage of Your Homes Future Value. Web The 2836 rule of thumb is a mortgage benchmark based on debt-to-income DTI ratios that homebuyers can use to avoid overextending their finances. Apply Now With Quicken Loans.

Ad Check Your Eligibility See If You Qualify for a 0 Down VA Mortgage Loan. Ad Put Your Home Equity To Work Pay For Big Expenses. Trusted VA Loan Lender of 300000 Veterans Nationwide.

Why Not Borrow from Yourself. Your monthly expenses include 1200. You have a pretax income of 4500 per month.

Web To calculate your debt-to-income ratio add up all of your monthly debts rent or mortgage payments student loans personal loans auto loans credit card payments. Web Debt-to-income ratio DTI is the ratio of total debt payments divided by gross income before tax expressed as a percentage usually on either a monthly or annual basis. Ad 10 Best House Loan Lenders Compared Reviewed.

Compare Now Find The Lowest Rate. 1 2 For example. Comparisons Trusted by 55000000.

Get Started Now With Quicken Loans. Most lenders look for a ratio of 36 or Get the Most. Web Here are debt-to-income requirements by loan type.

4000 Debt 10000 Income 40 DTI What is a Good Debt-to-Income Ratio Ratio. Ad Compare Mortgage Options Calculate Payments. Web Debt-to-income ratio total monthly debt paymentsgross monthly income.

Get Instantly Matched With Your Ideal Mortgage Lender. Receive 1000 Off On Pre-Approved Loans. If you have a salary of 72000 per year then your usable income for.

Web As a rule of thumb you want to aim for a debt-to-income ratio of around 36 or less but no higher than 43. Compare Mortgage Options Get Quotes. Ad Check Your Eligibility See If You Qualify for a 0 Down VA Mortgage Loan.

Web According to a breakdown from The Mortgage Reports a good debt-to-income ratio is 43 or less. Many lenders may even want to see a DTI thats closer to. Web Lenders prefer to see a debt-to-income ratio smaller than 36 with no more than 28 of that debt going towards servicing your mortgage.

If your home is highly energy-efficient. Web Usable income depends on how you get paid and whether you are salaried or self-employed. Trusted VA Loan Lender of 300000 Veterans Nationwide.

Its not a loan its a home equity agreement. Web But lenders often look for a debt-to-income ratio of 36 or less. Web DTI Debt Income.

Ad Use Our Comparison Site Find Out How to Get Home Loan Pre Approval In Minutes. Lock Your Rate Today. If You Owe Less Than 420680 Use A Government GSEs Mortgage Relief Program To Refi.

Lenders consider a DTI of 36 as. For example if your monthly pre-tax income. Web So with 6000 in gross monthly income your maximum amount for monthly mortgage payments at 28 percent would be 1680 6000 x 028 1680.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. You may find personal loan lenders that are willing to approve you for loans with a DTI over 40. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

Web Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator Generally lenders prefer your back-end ratio to be below 36 but some will allow up to 50 when applying for. A high debt to income DTI ratio is any mortgage scenario that exceeds 50 DTI.

:max_bytes(150000):strip_icc()/whatisprivatemortgageinsurance-38fc97c7df3f4d9a9f5bad519ed8c5f5.png)

What Is The 28 36 Rule Of Thumb For Mortgages

Debt To Income Ratio Calculator How It Affect Mortgages Moneygeek

Understanding Debt To Income Ratio For A Mortgage Nerdwallet

Abraxasoctober2016cataly

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Socio Economic Impacts Of The Covid 19 Pandemic On New Mothers And Associations With Psychosocial Wellbeing Findings From The Uk Covid 19 New Mum Online Observational Study May 2020 June 2021 Plos Global Public Health

Presentation Htm

![]()

Non Qm Non Agency Jumbo Residential Loans Stronghill

How To Get A Mortgage Home Loan Tips

Proptech Study By Proptech Switzerland Issuu

Report On The Living Conditions Of Roma Households In Slovakia 2010 By United Nations Development Programme Issuu

7 Best Heloc Lenders For February 2023 Lowest Fees Fastest Finder

Understanding Debt To Income Ratio For A Mortgage Nerdwallet

Business Succession Planning And Exit Strategies For The Closely Held

How To Get A Mortgage Home Loan Tips

Debt To Income Ratio Calculator How It Affect Mortgages Moneygeek

What S An Ideal Debt To Income Ratio For A Mortgage Smartasset